4 Financial services talent trends to prepare you for 2023

October 19, 2022The financial services market is currently experiencing big changes in consumer expectations around technology-first experiences. No doubt accelerated by the COVID-19 pandemic, which made online banking the standard, some regions are also closing physical bank branches which is also contributing to these digital experiences. As a result, financial services role requirements must also evolve with the times to ensure the right tech talent is hired. Recent data from labor market intelligence platform Claro Analytics has provided a holistic picture of how to best position your financial services roles moving forward. Here are four financial services trends you need to know for the remainder of 2022, next year and beyond.

Read more: 5 Talent solutions for the financial services market

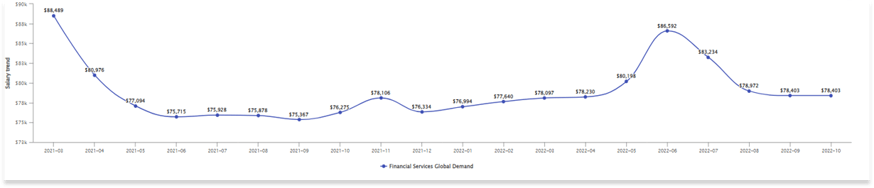

#1: Financial services salaries are still trending upward.

Click the image below for a larger view:

Trendline of average salaries in the financial services sector as of October 2022, where global demand (x-axis) denotes salaries on all publicly available open job postings.

Major takeaway: Globally, salaries in financial services are still experiencing growth due to a high demand for professionals despite the slowing economy and record inflation.

Between August 2021 to October 2022, there's been many peaks and troughs in global salaries for publicly posted financial services roles — but the overall trend has continued upward. With the ongoing collaboration between finance technology (fintech) and traditional banks and investment firms, the demand for professionals with tech experience to work with, and develop these systems internally, is continuing to grow despite the current economic market slowdown. This includes cybersecurity professionals to keep sensitive user data secure. To attract and retain finance talent, consider offering flexibility and perks that will encourage employees to stay longer. Employers must have comprehensive total rewards programs to be competitive in the market and differentiate themselves from other firms. This is vital — especially if you’re not able to offer the highest salaries. Also, be sure to offer career development upfront in your employee value proposition (EVP).

Also, don't forget to make sure you have a robust learning and development program— employees are willing to take reduced salaries if they’ll get training and upskilling opportunities. In fact, according to a Gallup survey, 71% of workers who undergo upskilling agree or strongly agree it’s enhanced their satisfaction with work.

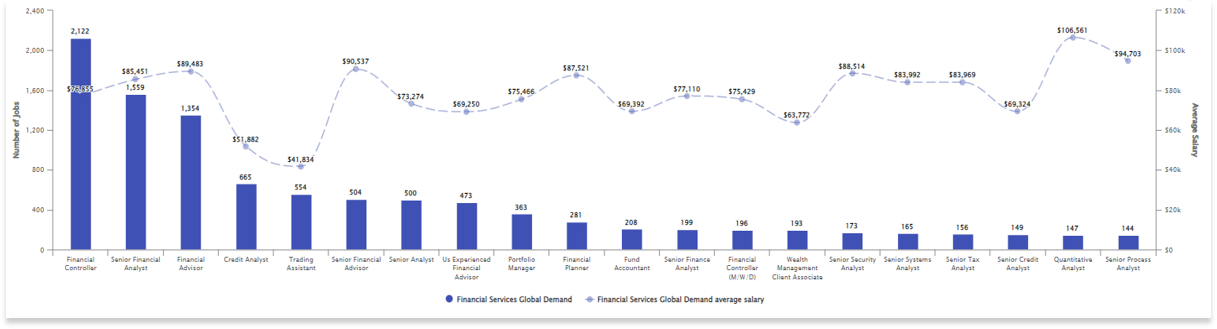

#2: The most popular financial services roles aren’t always the highest paid.

Click the image below for a larger view:

List of the most popular financial services job titles by the number of currently active job postings and salaries.

Major takeaway: Financial controller and analyst roles with big data experience are in high demand, but don't always have the biggest salaries. To help address the skills gap, consider roles that are hirable through internship and early careers programs.

To help combat rising salaries and the rampant skills shortages in the financial sector, investing in the next generation of workers is key. Jobseekers want to work for companies with strong cultures that have committed to the well-being of their people. Concentrate efforts around partnerships with local universities and institutions for ongoing recruitment opportunities.

Consider returnship programs, veteran programs and other career programs to make sure you’re actively supporting transferable skills between other verticals. Then, offer ongoing training, mentorship and upskilling to drive your employees toward new skillsets. Revamping your learning and development programs is mission-critical now to build healthy talent pipelines for the future.

Read more: Talent pipelining: How to plan for the biggest skills shortages

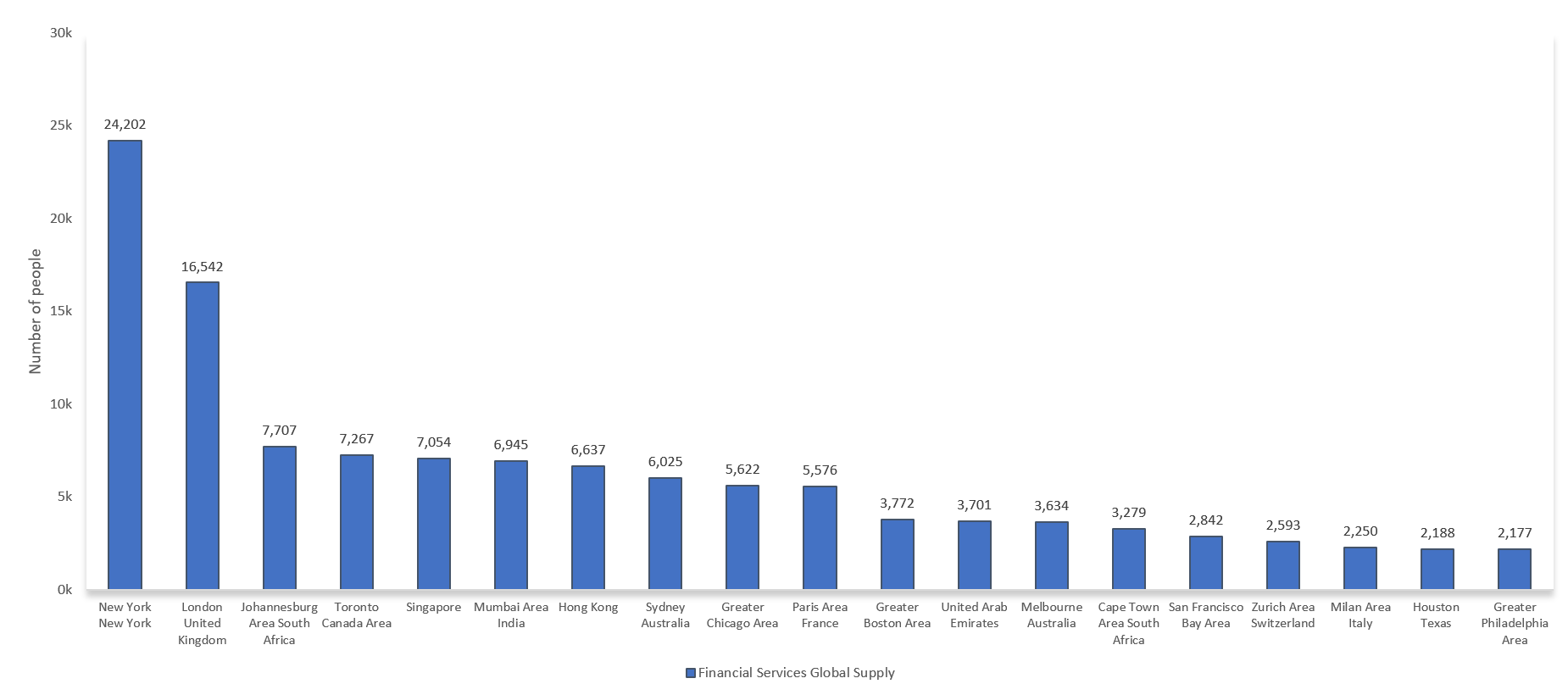

#3: Widen your search for finance professionals (they aren’t just in the US).

Click the image below for a larger view:

List of the most popular financial services talent hotspots globally.

With the rise of remote and hybrid work, if you’re capable, it’s time to look outside conventional areas for recruiting finance talent. Expanding your search for talent globally will help fill the gap of local skills shortages that exist in particular regions. Finance professionals with experience in multiple markets are highly sought after because they’ll have a broader knowledge of global regulations. An experienced recruitment process outsourcing (RPO) provider can help you find your total addressable market and where talent with your desired skills requirements are located. This can really help, especially when it comes to decisions on where to launch new facilities or relocate current ones.

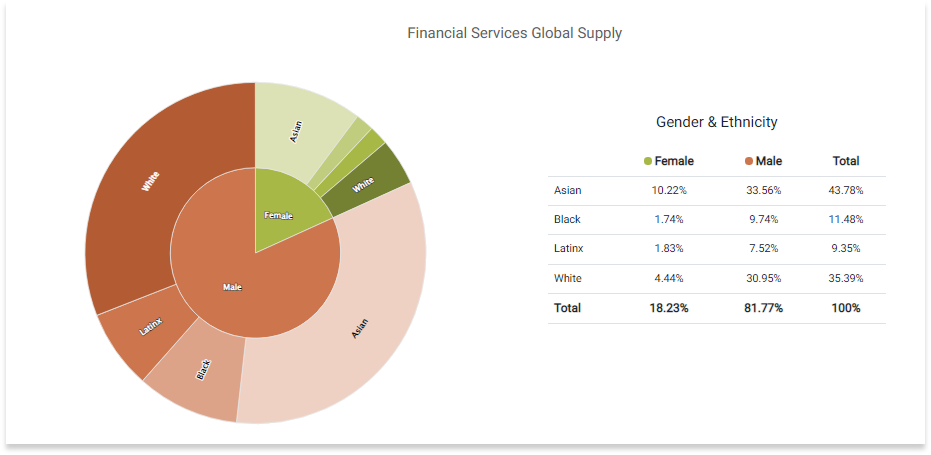

#4: Diversity hiring is still a top priority in the financial sector.

Click the image below for a larger view:

Gender and ethnicity (diversity) breakdown of the financial services talent globally as of October 2022.

Major takeaway: Slow progress is being made in closing the gap with ethnicity and gender disparity for financial services talent.

While progress is happening in terms of diversity, women of all races are still considerably underrepresented in the sector compared to men — just 18.23% compared to 81.77%. That’s why it’s crucial to continue networking with diverse organizations and universities to hire talent from all backgrounds, not just ones in Ivy League schools or networks limited to someone’s LinkedIn connections. Be sure to assess your application process to see if there are stages in which marginalized groups may be dropping out. If you can identify this point, you can better action and support them to move further through the process. That added support and insight will make a huge difference over time. Also, to help with diverse hiring, be open to professionals who may be coming back to the workforce after taking a break or those looking to make a career pivot from another sector.

Financial services trends continue to evolve...

In the financial services industry, many challenges have emerged from the COVID-19 pandemic, but there’s also plenty of opportunity. Programs that encourage the younger generations to consider financial services as a career are a good starting point. Expanding your talent search to be global will bridge critical skills shortages and help your business stay competitive. Focus on authentically spotlighting your EVP and perks throughout your recruitment marketing and offer flexible options to attract (and retain) talent.

About Craig Sweeney

As executive vice president, global strategic talent solutions, Craig leads WilsonHCG's growth strategy and new partnership cultivation across the globe. Alongside the trusted consultants at WilsonHCG, he builds market-leading, scalable and customisable RPO solutions. Craig's relationships span all industry verticals and geographies with expertise in technology, business services, financial services, engineering, manufacturing, retail, and media.