Accounting and finance insights: Hot skills and hiring trends across APAC

October 1, 2021CONTENTS

The business landscape in APAC has changed dramatically over the past 18 months. The pandemic has accelerated the pace of digital transformation in many companies. As the digital-first economy takes centre stage, companies need to adapt to the changing needs of both employees and consumers. The talent market is in a constant state of change right now, but one thing is certain: accounting and finance talent remains in high demand.

The first half of the year was busier than ever in the accounting & finance recruitment sector as many of the organisations that put hiring on hold last year regained momentum. As businesses carry on growing, we continue to see a demand for finance professionals who can become true business partners and advise on strategic decisions.

Candidates were cautious about making career moves amidst the pandemic as they were uncertain about the economic landscape. Recently, we have seen a greater willingness from candidates to look at new opportunities. However, we have also observed that candidates have more considerations as they assess a career move. In this report, we explore hiring and industry trends across the accounting & finance industry in APAC, as well as candidates’ response to the current market landscape.

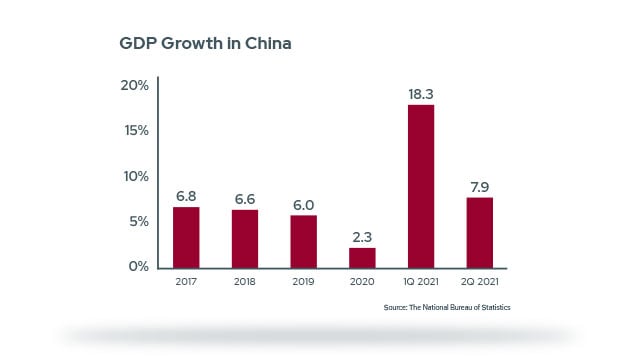

China

Gross domestic product (GDP) in China hit record levels during the first quarter of 2021 at 18.3% on a year-on-year basis, according to the National Bureau of Statistics of China. In Q2, the growth was not as high at 7.9%. Despite this drop, China's recovery has been strong and steady. It was the first major economy to come out of lockdown in 2020. The global landscape, however, is fraught with uncertainties as COVID-19 is running rampant in other parts of the world.

Like the rest of the world, businesses in China are currently navigating a talent market that has changed irrevocably. Many organisations are facing multiple challenges in the increasingly competitive job market, including a lack of focus on candidate experience, skills shortages, poor retention rates and low compliance with hiring standards.

Hot skills in China

Operational finance with IPO experience: Candidates with operational finance backgrounds and successful IPO experience are in demand. Employers are seeking finance candidates with a strong business acumen that can manage capital markets and oversee internal finance.

Investment banking: Bankers with solid IPO exposure in the Hong Kong market are highly sought after. Some listed companies, especially those with VIE (variable interest entity) structures, are considering moving to the Hong Kong capital market. Demand for candidates with this experience is high as a result.

Digital financial planning & analysis (FP&A): Candidates with digital FP&A experience are proving popular as companies seek to invest in in-house digital hubs to drive business growth. Technology know-how has become a requirement for many businesses looking for finance professionals due to the ever-increasing reliance on technology.

Audit/control/compliance: Finance professionals well versed in auditing, control and compliance-related roles are sought after, particularly by listed companies or organisations that plan to go for an IPO listing in the future.

Hong Kong

As we move towards the end of the year, the general sentiment among businesses in Hong Kong is that of positivity. Employers know that securing top talent is more challenging than it has ever been. Despite the chronic skills shortages and changing needs of candidates, employers in this region have remained stringent in their hiring processes.

Demand for accounting & finance professionals has risen steadily since Q4 2020. Companies are looking to hire finance professionals with strategic mindsets. And with many businesses working on their sales and growth targets for 2022, the demand for qualified talent is not slowing down.

Hong Kong is home to more than 600 fintech companies and start-ups. According to Invest Hong Kong, its favourable trading and investment climate has seen growth in the region over the last 12 months. These numbers are set to rise over the coming months, which will make the talent market even more competitive as companies vie for the same talent pool.

Hot skills in Hong Kong

Business partnering: Organisations are looking for finance candidates with the ability to work in a business partner role, especially in FP&A.

International experience: The pandemic caused severe disruption to supply chains, while business travel came to a standstill. As borders reopen and supply chains return to normal, finance talents with experience in global markets are highly sought after.

Mergers & acquisitions (M&A) experience: M&A activities tapered down during the initial phases of the pandemic due to uncertainty in the economic landscape. This year, we have seen an increase in the number of M&A taking place, and a rise in demand for candidates with experience in driving M&A.

Change management skills: Increasing numbers of companies are going through business transformation. Finance professionals experienced in change management are highly sought after to help manage new processes with minimum disruption to overall business operations as a result.

Business analytics: Candidates with strong analytical skills play a significant role in strategic decision-making. As businesses push forward with their growth plans, finance professionals with expertise in business analytics are in demand.

High emotion quotient (EQ): The world of work has changed due to COVID-19 and employee well-being has become a focal point for many companies. Therefore, finance professionals with a high EQ are in demand as employers want finance professionals who can lead their teams through periods of uncertainty and show empathy.

Japan

Hiring demand slowed in Q3 compared to the first six months of the year. Japan is now at a critical juncture with the pandemic and completion of the Olympic Games. We expect organisations to expand their hiring efforts and the demand for new finance professionals will steadily increase over the next few years.

Like many countries across APAC, candidates in Japan were cautious toward changing jobs during the height of the pandemic. However, this uncertainty is quickly fading. Candidates are now more interested in making a move and companies are showing renewed confidence and appetite around hiring. With demand for talented finance professionals far outstripping supply, the most sought-after candidates are receiving multiple job offers. To counter this, companies that have robust, yet flexible interview processes are gaining a competitive advantage to hire ahead of the competition.

Read more: [Whitepaper] Talent in Japan: Accelerating results in a candidate-driven market

Hot skills in Japan

Business partnering: Finance professionals with the right combination of analytical and communication skills are highly sought after. Those in highest demand are finance business partners who fully understand the business and can provide the necessary data-backed narrative from which solid strategic decisions can be made.

Stakeholder management: Many firms continue to seek candidates who can build solid relationships within the business and put in place the processes needed to ensure necessary strategic alignments across all functions.

Leadership: Expectations of the finance function continue to shift. And many firms in Japan are looking for agile and creative leaders to drive change and transformation around efficiency in an ever-changing and ambiguous environment.

High EQ: Within this extremely candidate-driven market, more emphasis is being placed upon the retention and development of employees. Senior finance professionals must foster positive working environments and be able to lead, develop and retain high performing teams.

Singapore

Singapore has reached a high rate of vaccination and we are seeing the economy showing good signs of recovery. In Q2 this year, Singapore saw 14.7% year-on-year economic growth – a significant increase from the 1.5% in Q1. The Ministry of Trade & Industry (MTI) has upgraded the GDP growth forecast for 2021 from between 4 and 6% to between 6 and 7%. These adjustments account for the better-than-expected performance of the Singapore economy in the first half of the year along with the latest external and domestic economic developments.

However, the pandemic remains a significant near-term risk and adds uncertainty over the medium-term outlook for growth. The general outlook for hiring remains cautious. APAC remains an important region for global businesses. Singapore is viewed as an ideal location for regional offices due to the large pool of qualified talent with good regional exposure.

We have seen an increase in the number of companies that are undergoing restructuring in the region as well as enterprise-wide transformation initiatives. We continue to see redundancies in companies, yet on the same note, these organisations are still hiring, although in more specialised niche functions.

Hot skills in Singapore

Business analytics: To better forecast business changes and assist in strategic decisions, finance talent with data analytics and big data management experience are valued. Hiring activity is likely to rise for FP&A, commercial finance and finance business partnering professionals who have exposure to data analytics tools like SQL, R, Tableau, Python, SAS and QlikView.

Strategic & finance business partnering: Firms are seeking finance professionals to provide insights in driving recovery and performance, with high demand for commercially astute finance professionals who possess the gravitas to engage with key stakeholders.

Finance transformation & robotic process automation (RPA): More organisations have been embarking on finance transformation initiatives to drive process and system improvements. Candidates who can lead finance transformation projects relating to process improvements are highly valued. Accounting professionals experienced in implementing RPA within large organisations are also in high demand. Even mid-sized businesses are looking to adopt such technologies to stay competitive and efficient.

Supply chain finance: The ongoing pandemic has exposed just how much supply chains can make or break a company’s success. Finance leaders with deep experience in partnering with supply chain leaders can bring value, including financial impact analysis, the evaluation of capital investments, effective inventory planning, identifying and managing risks and optimising performance.

In-house corporate finance and strategy: The COVID-19 pandemic has created opportunities for businesses with good financial positions to look into M&A. Hiring for in-house M&A positions is rising, as well as in-house corporate strategy roles to support both inorganic and organic growth.

Risk management: Increasing economic volatility and complexity have elevated the importance of risk management as a critical function. Companies are upping their efforts to establish a more systematic approach to analysing business risks and opportunities and identifying strategies for managing risk.

Increased emphasis on soft skills: We are seeing more emphasis on soft skills as part of the hiring criteria. This includes stakeholder engagement skills, critical thinking, learning agility and the ability to drive change. When recruiting new employees in 2021, many clients have cited communication as the most sought-after soft skill.

Recent hiring trends in APAC

- The market is still very dynamic in China, and finance talent is in high demand to support business expansion plans. Many employers are looking for finance professionals to become true business partners and provide strategic guidance.

- In Hong Kong and Singapore, accounting & finance professionals are increasingly open to moving roles. They know they are more in demand now compared to the previous 24 months. However, the consensus right now among candidates is that of caution and they will only make considered moves in light of the current economic landscape.

- When considering a career move, finance candidates are looking closely at business performance to ensure they make the right decision. They are also seeking opportunities to develop and progress. When asked why they are considering leaving their current organisation, almost two thirds (59%) of respondents cited a lack of career growth and developmental opportunities, according to our 2020 Working in APAC report.

- The number of finance professionals looking to switch industries, not just companies, has gone up. FinTech is fast becoming an attractive sector, but potential applicants still have some doubts. Company stability and funding is a major concern despite being a desirable industry. Organisations should be prepared to answer questions on these topics from potential candidates.

- Accounting & finance candidates now seek more flexibility and improved work/life balance when considering a move. The pandemic has led many people to question what they want from a job. Coupled with the surge in remote working during enforced lockdowns, this means many are prioritising positions in companies that allow for a better balance.

What do candidates look for in a company?

As the job market continues to bounce back, candidates are considering several key factors when assessing a career move:

- Career growth and development opportunities

- Flexible working

- Financial rewards and relevant employee benefits

- Organisation leadership and culture

- How much financial stability potential employers have

Key Industries that are hiring

The industries with the most hiring activity for finance roles right now include the following:

- Healthcare and life sciences

- Technology, digital and ecommerce

- Consumer goods and food manufacturing

- Athleisure and sporting goods

Retention of talent

As the job market continues to pick up, there is an increased need for companies to ensure they have robust talent retention strategies in place. In this highly competitive market, it is more important than ever to regularly review your employee value proposition (EVP). Employers that take steps to foster environments where employees feel safe, valued and empowered will be better able to retain their talent. Organisations with a compelling EVP have an advantage over the competition as they will find it much easier to successfully attract highly qualified candidates and retain their best employees.

Related content

The only way is tech: Why digital skills are still in high demand in APAC

About Yvonne Goh

Yvonne is a Managing Director overseeing our executive search practice for the industry and commerce sector, located in Singapore. She specialises in senior mandates with a focus on finance and accounting, sales and marketing and general management across Southeast Asia. Yvonne has more than 20 years of executive search experience, with a background in senior finance recruitment at an international firm in Singapore.